Laila Basmati Fastest Growing Rice Brand of 2017

8 Nov 2017

Laila basmati has bucked the trend of a shrinking dry rice market achieving staggering triple figure spend growth during Ramadan, latest Kantar Worldpanel figures reveal.

Laila basmati has bucked the trend of a shrinking dry rice market achieving staggering triple figure spend growth during Ramadan, latest Kantar Worldpanel figures reveal.

Laila's Ramadan sales were up 115%, against the backdrop of an overall Ramadan market which declined at 3% year on year (YOY)** and recorded the strongest volume sales uplift in the top 5 dry rice brands (Up 103%).***

The latest Kantar WorldPanel data also reveals the brand was the top performer annually with YOY growth of more than 60%.

The leading, authentic basmati rice brand, among the UK Top 10, grew 64% during the last year*. The achievement is particularly impressive given the fact other leading brands, including Tilda and Uncle Bens, saw YOY slides of 17% and 12% respectively.

Only the discounters managed to keep pace with Laila with Lidl, up 39%, and Aldi, up 19%, in YOY spend. Laila's impressive achievement is set against the backdrop of an overall dry rice category which has shrunk, ever so slightly, by 1% YOY.****

Harry Dulai, Managing Director of Surya Foods, owners of the Laila brand, said: "To achieve an annual 64% uplift in sales on a brand that is already in the UK top 10 is just remarkable and we are thrilled with the latest figures which affirm our position as a category leader.

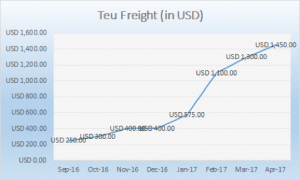

"These charts reflect a concerted sales drive during the last year to grow the Laila rice brand and are testament to the enormous efforts across our business from production and manufacturing to sales and marketing.

"The Laila brand remains at the heart of Surya Foods as a business and we will continue to invest heavily in marketing and sales activity to see it grow further and also increase its appeal to a mainstream market that appreciate authenticity."

The impressive Laila stats continued across the board and documented:

- Annual growth of 64%*.

*Kantar Worldpanel 52 w/e, 13thAugust, Total Dry Rice, value sales

- Triple figure spend growth (Up 115%) during the Ramadan Period in comparison to the overall market, which declined at 3% YOY.

**Kantar Worldpanel 12 w/e, Total Dry Rice, 18th June 2017

- Excellent spend growth during the Ramadan period with the strongest volume sales uplift in the top 5 dry rice brands (Up 103%)

*** Kantar Worldpanel 12 w/e, 18thJune, Total Dry Rice, Volume sales (000s)

- Strong annual volume sales growth of 48% YOY in an overall category which saw a 1% volume decline YOY.

****Kantar Worldpanel 52 w/e, 13thAugust, Total Dry Rice, Volume sales (000s)

- The fastest growth rate in 10kg sector of 143% - smashing the market YOY average of 12%

Kantar Worldpanel 52 w/e, 18thJune 2017, 10kg, Total Dry Rice, value sales

- YOY volume sales growth into triple figures, up 139%

Kantar Worldpanel 52 w/e, June 2017, 10kg, Total Dry Rice, Volume sales

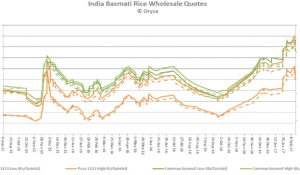

As part of its continued commitment to expand the Laila brand, the world food specialists added a premium 1121 range to its top-selling line-up with the launch of

Laila Xtra Basmati Supreme last year. 1121 is one of the world's most prized rice varieties with an exquisite aroma and delicate texture which is defined by its extra long slender grains. The range is aimed at an increasingly foodie UK audience and has already secured listings with national retailers Sainsbury's, Tesco and Asda.

Laila's leading, traditional basmati brand features in the UK's top ten rice brands and is the top selling rice on the world food aisles of national retailers Tesco and Asda.

- ENDS -

If you are interested in seeing the full Kantar Worldpanel Dry Rice Category report please contact: pr@suryafoods.com

Note to Editors - Laila Basmati Rice

- Laila is one of the UK’s leading basmati rice brands and is owned by world food giants Surya Foods. It is the top selling rice brand on the world food aisles of national retailers Tesco and Asda. Established in 1996 to bring high quality, authentic basmati rice to the rice-eating Asian community of the UK, Laila has become one of the nation's favourites, popular with consumers and ethnic chefs alike due to its quality and authenticity.

- The Laila brand has expanded rapidly in recent years and now includes a complete range of flours, attas, ghee butter, pickles and curry pastes, sourced from around the world, to help UK consumers create delicious, authentic dishes in their own homes, using a brand they have come to know, love and trust.

- Surya Foods is one of the largest suppliers of authentic world foods to the UK food sector. Its unrivalled, extensive world food ranges has seen it become the biggest supplier of world food lines into supermarket giants Tesco, Asda, Sainsbury's and Morrisons, with extensive independent retail accounts across the UK. Laila basmati features in the UK's top ten rice brands (2015 Nielsen data).

- Surya's evolving ranges cater to the South Asian, Korean, Chinese, Thai, West African, Caribbean, African, South American and Polish communities, with Arabic and Mediterranean products added to its world food line up in 2015. With 2,000 products available, Surya represents over 50 agency lines from some of the world’s leading companies.