Indian Basmati Rice Industry viz a viz U.K & European Markets: Trends & Outlook

12 Apr 2017

Rice is one of the most crucial food crops in the world and a staple diet for nearly half the global population. Over 90% of the global rice output and consumption is centered in Asia, wherein the world’s largest rice producers China and India, are the world’s largest rice consumers.

Rice is one of the most crucial food crops in the world and a staple diet for nearly half the global population. Over 90% of the global rice output and consumption is centered in Asia, wherein the world’s largest rice producers China and India, are the world’s largest rice consumers.

High domestic consumption and restrictive trade policies of several countries have restricted the international trade of rice to 6-7% of production. Food security objectives and the need to provide income support to domestic producers are the main reasons cited by countries, thus restricting rice imports.

Among the several varieties of rice, Basmati is considered the most superior in terms of product characteristics and therefore, the most premium. Basmati rice constitutes a small portion of the total rice produced in India. By volume, the share of Basmati in total rice production is around 6% (as of FY2016) but by value, Basmati exports account for 60% (as of FY2016) of India’s total rice exports. Further, exports have increased at CAGR of 13% from 2010 to 2016.

Industry Updates - Production Decline:

Basmati paddy prices witnessed significant decline in FY2015 and FY2016 thus becoming a less attractive option for farmers, hence the decline in cultivation in this current year. The total area under cultivation is expected to have fallen from around 2.1million hectares in FY2016 to 1.6 million hectares in the FY2017. Resulting in a production decline from around 9.8 million tonnes to around 8.0 million tonnes during the same period

Outlook – Origin & Global factors:

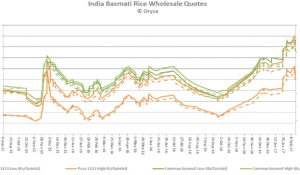

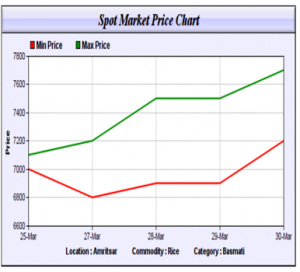

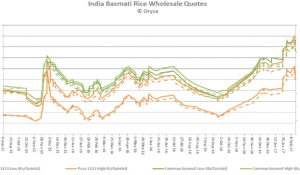

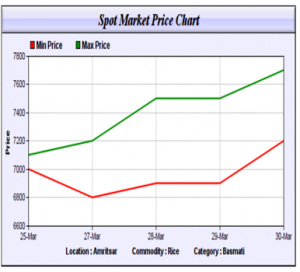

- Raw Material and Finished Product Prices in Origin: Basmati Paddy Prices are up by close to 40% in last 5 months since the new crop arrived in Nov 2016. Basmati finished product for wholesale prices have increased by 35% in last 3 months and there has been a significant upward trend (in last 2 weeks on account) of depleting market inventories. Chart 1 & 2 provide insight on trend of prices over this period and current short term scenario.

- Chart 1: Basmati Wholesale Prices: 2 Years Trend Chart 1: Basmati Spot Rates, March17 W4

- INR to USD currency trend: From close to an all-time high of 68.50 INR / USD in Oct, Indian Rupee has strengthened back by 7% in last 4 months, leading to lesser realization of exporters in INR terms and thus increased cost of exports. With an increase in the confidence level of FII’s post demonetization move in Nov 2016 and BJP winning in key state elections in March, INR is expected to be strengthening further. Chart 3 provides insight into the currency trend.

- Chart 3: INR to USD, 1 Year Currency TrendGBP to USD currency trend: From 1.59 levels in March 2015, GBP has depreciated by around 24% and it stands at 1.215 levels in Mid-March 2017. A Depreciation of app. 15% in last 6 months itself is leading to higher cost of Import into U.K. Chart 4 provides insight into the trend.

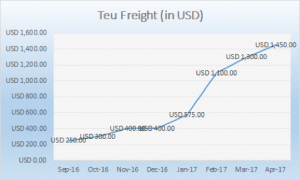

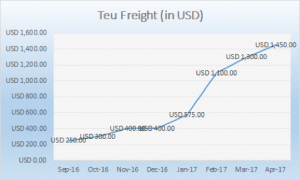

- Exponential increase in Ocean Freights: Shipping lines have cut capacities, enforced weight restrictions and implemented GRI’s. This has led to increases close to 500% in freight costs in last 6 months. Brown Basmati Rice being a relatively low cost import however, the fright cost component has increased from 1% to presently 7% of the U.K Basmati Manufacturers input cost. Chart 5 provides insight into the trend on Freights from India Ports to U.K Ports.Chart 4: GBP to USD, 2 Years Currency Trend

- K Market reaction:

- Due to various factors collated together, there is in general a shortage of Basmati Rice in U.K.

- Shortage of containers and space with shipping lines and enforced weight restrictions in march 2017 are adding to the woes.

- Some millers are already re-negotiating ongoing contracts.

- Also with limited stocks to sell, sales are being affected on the basis of priority stock allocations.

- Prices are expected to remain firm.

- Brexit: With Re-negotiation of Brexit in process, the future impact on Imports, Trading and Tariffs is unknown and may require 2-3 years to understand the real impact.

- Upcoming Issues:

-

- Labour Rates and Operating Costs for Manufacturing & Distribution in U.K: Due to inflationary pressures and the evolution of markets taking into account factors like Brexit, operating costs in U.K have increased by around 4% in last 1 Year. This is adversely effecting the costs and therefore the need for price increases.

- Chart 5: 6 Months Teu Freights Trend from India to U.K Ports

- Pesticide Restrictions and chances of industry to get skewed: With max allowed levels of 0.01% to be allowed and upcoming stringent controls post Dec 2017, there are chances of many fragmented segment players either moderating down or existing from the market. Also this will lead to a rise of a need to control at agriculture level from major players, which would come at a price and would increase costs.

- (Source: ICRA, Agriwatch, Riceonline, ec.europa.eu, xe, APEDA, Oryza, Surya Internal Monthly Market Commentary, 7th April 2017)